Magyron Fundix:

Magyron Fundix: Valós idejű intelligencia a bölcsebb kriptós döntésekhez

Regisztrálj most

Regisztrálj most

A Magyron Fundix jelentős előnyt biztosít a kereskedők számára egy olyan MI-keretrendszer révén, amely valós időben alkalmazkodik a piac ritmusához. Legyen szó kezdő vagy tapasztalt felhasználókról, a Magyron Fundix a fejlett adatfeldolgozás és az érthető elemzések segítségével támogatja a megalapozott döntéshozatalt.

A Magyron Fundix gépi tanulási eszközei világszerte elemzik a kriptopiaci mintázatokat, hogy észleljék azokat a finom jeleket és ármozgásokat, amelyek mások figyelmét elkerülhetik. A folyamatos monitorozásnak köszönhetően a felhasználók időben léphetnek a kulcsfontosságú piaci fordulatok előtt, maximális átláthatósággal és kontrollal.

A Magyron Fundix másolásos kereskedési modulja lehetővé teszi, hogy a felhasználók egy mentor iránymutatása mellett megfigyeljék és lemásolják a kiválasztott kereskedési lépéseket. A Magyron Fundix minden funkciója felhasználóbarát kialakítású, ami gyorsabbá és hatékonyabbá teszi az egész folyamatot.

A Magyron Fundix korszerű, élvonalbeli MI-eszközöket használ a globális kriptopiacok ingadozásainak nyomon követésére. A többrétegű adatvizsgálaton alapuló valós idejű elemzések segítenek strukturált képet adni a trendek lendületéről. A felhasználói döntések manuális adatfeldolgozás nélkül kapnak iránymutatást, miközben a biztonság elsődleges szempont marad, és az intuitív felület zökkenőmentes használatot biztosít.

A Magyron Fundix használatával a kereskedők egy olyan eszköztárhoz jutnak, amely átlát a piaci zajon, és kiemeli a valóban cselekvésre alkalmas jelzéseket. A rendszer mesterséges intelligenciája hatalmas mennyiségű adatot elemez, és kiszűri azokat a tényleges mozgásokat, amelyek figyelmet igényelnek, lehetővé téve a felhasználók számára, hogy a pontos belépési vagy kilépési zónákra összpontosítsanak.

A Magyron Fundix intelligens modelleket alkalmaz a változó piaci erők elemzésére. Alapját képező gépi tanulási rendszer idővel alkalmazkodik, miközben figyelembe veszi a múltbeli viselkedési mintákat és az élő piaci mutatókat egyaránt. Ez magában foglalja azokat a területeket is, ahol érték teremthető, az alakulóban lévő viselkedésekhez igazodva. A Magyron Fundix ezáltal lehetővé teszi a felhasználók számára, hogy stratégiai szemlélettel gondolkodjanak és világosan reagáljanak, gyors és releváns értelmezésekre támaszkodva. A rendkívül volatilis kriptovaluta-piacok veszteségek kockázatát hordozzák magukban.

A Magyron Fundix másolásos kereskedési funkciója lehetővé teszi a felhasználók számára, hogy megismerjék, miként épülnek fel a hatékony stratégiák, és azokat korlátlan módon alkalmazzák. Minden egyes stratégiát teljesítményelemző modulok védenek, amelyek kiértékelik az eredményeket és alakítják a fejlődést. A Magyron Fundix nem pusztán a kereskedések lemásolásáról szól, hanem arról, hogy képessé tegye a résztvevőket arra, hogy a legjobb gyakorlatok alapján saját döntéseiket hozzák meg.

Az adatvédelem kezelése terén a Magyron Fundix magas szintű szabványokat tart fenn még akkor is, ha a platform nem bonyolít le pénzügyi tranzakciókat. A strukturált adatbiztonsági irányelvek garantálják, hogy az információk mindenkor védettek maradjanak. A felhasználók ellenőrzött környezetben kapnak hozzáférést az MI-alapú elemző eszközökhöz, mentesen az esetleges kockázatoktól vagy külső kitettségtől az MI használata során.

A Magyron Fundix célja, hogy a mesterséges intelligencia segítségével erősítse az emberi döntéshozatalt, nem pedig hogy automatizálja azt. A platform elemzi az összetett adatokat, figyeli a lendület változásait, és tiszta képet ad a piaci mozgásokról. Ahelyett, hogy leegyszerűsítené a felhasználók ítélőképességét, a Magyron Fundix tovább élesíti azt, a hagyományos modelleket finomítva, hogy mindenki valós időben jól értelmezhesse a technikai mintázatokat és az alkalmazkodó piacot.

Annak érdekében, hogy a felhasználók lépést tartsanak a változó piaci hangulattal, a Magyron Fundix folyamatosan elemzi a globális adatokat. Ez olyan frissítésekhez vezet, amelyek kiemelik a jelentős átalakulásokat, növekedési mintákat vagy lehűlésre utaló jeleket. Ezek az eszközök lehetővé teszik, hogy a felhasználók előrelátó módon módosítsák stratégiáikat, csökkentve a találgatást és felkészülve a kedvező piaci időszakokra.

A piacon megjelenő félrevezető információk sokasága miatt kiemelt hangsúlyt kapnak a Magyron Fundix által generált trendszignálok. A kriptó iránt érdeklődők olyan cselekvési tervet alakíthatnak ki, amely tényeken alapul, nem pedig mítoszokon. A Magyron Fundix több MI-komponenst alkalmaz e cél eléréséhez, így a kereskedők időben fedezhetik fel a lehetőségeket.

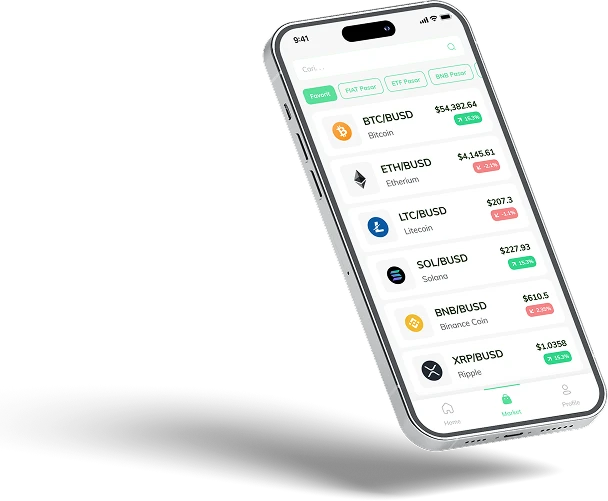

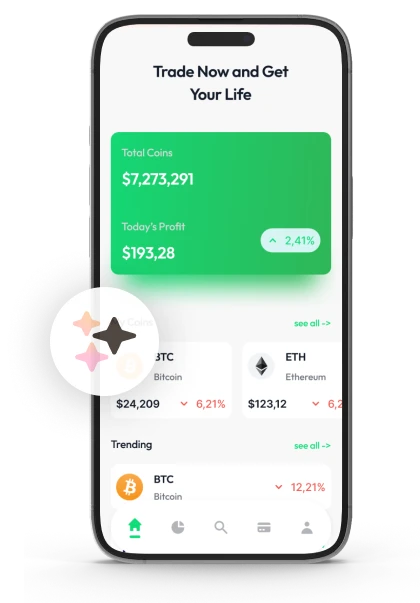

A Magyron Fundix mobilbarát platformot kínál, amely pontosan követi a kereskedési rendszereket és felméri a piaci hangulatot. A piaci mozgásokat folyamatosan korrigálja az aktuális körülményekhez leginkább illeszkedő stratégiák azonosítása érdekében. Mindezt egységes adatértelmezéssel kiegészítve a Magyron Fundix lehetővé teszi a hatékony tervezést még a gyakran változó piacokon is.

Ahogy a piac változik, úgy alkalmazkodnak a Magyron Fundix MI-modelljei is. A rendszer tanul a múltbeli adatokból, és teljesítményét az új mutatókhoz igazítja, lépést tartva a kriptopiacok gyors átalakulásával. Ennek eredményeként az elemzések érthetőbbek, aktuálisabbak, és világos taktikákkal segítik a felhasználót.

Megállíthatatlan működésének köszönhetően a Magyron Fundix folyamatosan figyeli az értékre utaló jelzéseket és a piaci változókat. Különböző forrásokból származó valós idejű adatfolyamokat használva azonosítja a kibontakozó mintákat, ami lehetővé teszi a gyors reagálást hosszas várakozás és körülményes elemzés nélkül.

A Magyron Fundix könnyen elérhető technikai támogatást nyújt, biztosítva, hogy az eszközök használata ne okozzon frusztrációt. A funkciók bemutatásától az elemzések értelmezéséig a rendszer minden felhasználót támogat, függetlenül a tapasztalati szinttől. Az eredmény egy olyan platform, amely egyszerre mélyreható és könnyen kezelhető.

A Magyron Fundix korszerű, élvonalbeli mesterséges intelligenciát alkalmaz a digitális eszközök trendjeinek valós idejű nyomon követésére. A folyamatosan változó információk gyors elemzésével a platform lehetővé teszi a felhasználók számára, hogy időben felismerjék a változásokat és kihasználják azokat. A megnövelt adatátláthatóságnak köszönhetően a felhasználók pontosabb képet kapnak arról, mikor érdemes cselekedni vagy éppen kivárni, függetlenül felkészültségi szintjüktől.

Az ismétlődő piaci ellenőrzések helyett a felhasználók a Magyron Fundix-re támaszkodhatnak, amely strukturált jelzéseket kínál, megszüntetve a találgatás szükségességét. A professzionálisan kialakított modellek elemzik és értelmezik a jelentős trendeket, sürgősségérzetet adva a felhasználóknak. Legyen szó a forgalom növekedéséről vagy a lendület lassulásáról, a rendszer aktuális és releváns betekintéseket nyújt, nem pedig utólagos, statikus elemzéseket.

A biztonság a teljes folyamat szerves része. A Magyron Fundix erős kriptográfiai megoldásokat és többlépcsős védelmet alkalmaz annak érdekében, hogy minden platformon belüli „tranzakció” biztonságos legyen. Emellett könnyen hozzáférhető tananyagok állnak rendelkezésre mind a kezdő, mind a tapasztaltabb felhasználók számára. A Magyron Fundix környezetében a felhasználók hosszú távon, következetesen tarthatják fenn kriptós tevékenységeiket anélkül, hogy a lendület elveszne a „úszni vagy elsüllyedni” kényszere miatt.

A Magyron Fundix segíti a kriptovaluta-elemzés rendszerezését több stratégiai nézőpont integrálásával. A rendszer egyaránt alkalmas rövid és hosszú távú kereskedési stílusokhoz, és mindkettőhöz biztosítja a szükséges eszközöket. A felhasználók döntéseit és módosításait valós adatok támasztják alá, így a piaci tevékenységekben vertikális összhang, ugyanakkor horizontális rugalmasság valósul meg.

A Magyron Fundix a felhasználói paraméterekre szabott elemző modelleket alkalmaz az ármozgások változásainak, fordulópontjainak vagy kitörési mintáinak azonosítására. Ezekre az eszközökre támaszkodva a felhasználók a saját kereskedési stílusuknak megfelelően igazíthatják a belépés időzítését. Legyen szó rövid távú pozícióépítésről vagy hosszabb távú stratégiákról, a Magyron Fundix megkönnyíti az átgondolt, nem reaktív tervezést.

Egyes kereskedők kizárólag a gyors belépésekre és az azonnali kilépésekre összpontosítanak, míg mások hajlandók hosszabb ideig pozícióban maradni abban a reményben, hogy a piaci trend kibontakozik. A Magyron Fundix mindkét megközelítést támogatja, mivel a piaci struktúrát a teljes idősík-spektrumon figyelembe veszi. Ez kiegyensúlyozott megértést tesz lehetővé, így a felhasználók különböző stratégiai formákat értékelhetnek, és céljaikhoz valamint kockázati szintjükhöz igazodva választhatják ki a megfelelő megközelítést vagy opciókat.

A felkészülési szakasz egyik kulcseleme annak ismerete, meddig érdemes elmenni. A Magyron Fundix az aktuális piaci helyzet alapján kiemeli a fontos határszinteket, lehetővé téve a belépési, kilépési vagy stop szintek meghatározását. Ez különösen hasznos a stratégiák finomhangolásakor vagy olyan taktikai tervek kialakításakor, amelyek összhangban vannak a kockázatokkal és a kitűzött célokkal.

A likviditás az eszközök kereskedésen belüli áramlását mutatja, amelyet egyszerre jellemez rend és káosz. A Magyron Fundix segít a felhasználóknak megérteni ezeket a trendeket az ügyletek végrehajthatóságának felméréséhez. Léteznek szélsőségesen negatív szintek, amelyek alacsony likviditást jeleznek, valamint pozitív zónák magas likviditással. A kriptovaluta-piacok volatilisek, és jelentős veszteségek kockázatával járnak.

A mesterséges intelligencia a nagy volumenű környezetekben támogatja a gyors piaci változások megértését, így megbízható szövetséges. A Magyron Fundix modell segít az objektív döntéshozatalban azáltal, hogy kiküszöböli a feltételezéseket. Különösen hasznos lehet olyan helyzetekben, amikor gyors változások és erős nyomás várható a piaci szereplők részéről. Ugyanakkor a Magyron Fundix kizárólag adatokra támaszkodik, és fontos tudatosítani, hogy a kriptovaluta-piacok nem elhanyagolható kockázatokkal járnak.

A Magyron Fundix egy technikai eszköztárral érkezik, amelyet azoknak a kereskedőknek terveztek, akik módszereiket mintafelismerésre és precíz időzítésre alapozzák. A csomag olyan eszközöket tartalmaz, mint a Relatív Erősség Index (RSI), a Bollinger-szalagok és az exponenciális mozgóátlagok (EMA), amelyek egyaránt hasznosak a trendek, a belépési lehetőségek és a piaci kifáradás jeleinek azonosításában.

A Bollinger-szalagok a magas volatilitás szintjeit jelzik, míg az RSI megmutatja, hogy egy adott eszköz túladott vagy túlvett állapotban van-e. Az EMA segít a kereskedőknek jobban megérteni a piaci dinamikát a rövidtávútól a hosszú távú idősíkokig. Ezekkel a funkciókkal a Magyron Fundix támogatja a felhasználókat abban, hogy az erősségekre és a piaci ritmusra összpontosítsanak a zaj helyett.

A mesterséges intelligencia levágja a zavaró piaci zajt, és a valóban releváns időszakokra sűríti az információt. Az egyes felhasználók egyéni preferenciáihoz igazodva az eszközök személyre szabhatók, elősegítve a megalapozott, kiegyensúlyozott kereskedést.

A piaci irányokat gyakran már a tömegek hangulata befolyásolja, még azelőtt, hogy a technikai indikátorok egyértelmű képet rajzolnának. A Magyron Fundix MI-alapú hangulatkövető eszközöket alkalmaz, amelyek az internet egészét átfogják, és figyelik a hírekben, a közösségi médiában, valamint a kereskedési mintákban megjelenő hangulatváltozásokat. Ezek az eszközök segítenek a felhasználóknak megállapítani, hogy „kockázatvállaló” (risk-on) vagy inkább „kockázatkerülő” (risk-off) piaci környezet uralkodik-e.

A puszta ármozgás-alapú technikákon túl sok tapasztalt kereskedő fontosnak tartja tudni, hogy a piac emelkedése vagy esése idegesség, túlzott magabiztosság vagy éppen bizonytalanság következménye-e. Ezen a téren a Magyron Fundix feltárja a megnyilvánuló érzelmi tényezőket, és összekapcsolja azokat a rendkívül volatilis árformációkkal és a dinamikus ármozgási mintákkal.

A trendmegfigyelésekkel kombinálva a hangulatelemzés egy további réteget ad a döntéshozatalhoz. A különböző adatforrásokból származó hangulat alakulására összpontosítva a Magyron Fundix segít a felhasználóknak tájékozottnak maradni, gyorsan alkalmazkodni, és kevésbé az azonnali impulzusokra reagálni. A kriptovaluták kereskedése magas kockázattal és veszteség lehetőségével jár.

Az olyan kulcsfontosságú gazdasági mutatók, mint a kamatlábak, az infláció és a foglalkoztatottsági adatok, jelentős hatással vannak a digitális piacokra. A Magyron Fundix mesterséges intelligenciát alkalmaz ezen tényezők nyomon követésére, valamint annak értékelésére, miként befolyásolják a felhasználói hangulatot és a piaci volatilitást.

A hirtelen szabályozási változások vagy gazdasági elmozdulások drámai piaci mozgásokat válthatnak ki. A gazdasági mintázatok és a devizapiaci mozgások elemzésével a Magyron Fundix segít a felhasználóknak azonosítani a hosszabb távú összefüggéseket, és előre jelezni a makrogazdasági változások lehetséges következményeit.

A helyes döntéseket a megfelelő időben kell meghozni, akár a piaci változásokra reagálunk, akár azokat előre próbáljuk jelezni. A Magyron Fundix a múltbeli és aktuális ármozgásokat modellezi, segítve a felhasználókat a változási időszakok előrejelzésében. Az árkitörések, trendfordulók és konszolidációs minták korai felismerése lehetővé teszi, hogy a felhasználók megelőző lépéseket tegyenek időben.

A Magyron Fundix azonosítja a mintákat, töréspontokat, valamint jelzi a lehetséges kockázatokat és lehetőségeket, így segít előre jelezni, miként hathatnak a gazdasági változások a tőkepiacokra. MI-meghajtással gyors adatfeldolgozást biztosít anélkül, hogy túlterhelné a felhasználót. Tekintettel a kriptovaluta-piacok rendkívüli volatilitására, minden kereskedési tevékenység potenciális veszteséggel járhat.

Az egészséges portfólióstruktúra fenntartása és annak időben történő módosítása kulcsfontosságú. A Magyron Fundix különböző befektetéseket elemez annak érdekében, hogy feltárja a piaci turbulenciákkal szembeni legjobb ellenállási módokat. Eszközöket kínál az allokációk megtervezéséhez és a túlzott kockázat kezeléséhez, ami pozitívan hat a portfólió teljesítményére a piaci elmozdulások idején, és magabiztosabb eligazodást tesz lehetővé a változó körülmények között.

Még a gyorsan mozgó piacokon is kimutathatók a visszaesések vagy növekedések apró ingadozások révén. A Magyron Fundix korán azonosítja a hiteles mozgásokat, felismerve az olyan jeleket, mint a rövid esések mögötti ralizás vagy a felső ársávokban kialakuló kitörések. Ezek a megfigyelések segítenek minimalizálni a csúszást, és lehetővé teszik a pozíciók gyors igazítását a változó körülményekhez.

Egyes trendek finoman indulnak: volumeneltolódásokkal, kisebb fordulatokkal vagy hosszan tartó oldalazással. Az MI-alapú lendületmodellek segítségével a Magyron Fundix korán észleli ezeket a mintákat, és a jelzéseket jól értelmezhető vizuális formában kategorizálja, hogy a felhasználók cselekedhessenek. Ez az előrelátó nézőpont segít jobban megérteni és felkészülni a kialakuló piaci erőkre.

A kriptovaluta-piacok szélsőséges volatilitásukról ismertek. A Magyron Fundix MI segítségével folyamatosan figyeli az ármozgásokat, és riasztja a kereskedőket, amikor az árak eltérnek a trendektől. Ez növeli a kockázatokkal és a hirtelen elmozdulásokkal kapcsolatos tudatosságot, segítve a gyorsabb reakciót és a kedvezőtlen mozgásoknak való kitettség csökkentését.

A Magyron Fundix a stratégiát és a gépi tanulást ötvözi, felhasználóbarát felületen kínálva fejlett elemzéseket. MI-rendszerei hatalmas mennyiségű aktuális és történeti adatot vizsgálnak, és a trendeket még azok nyilvánvalóvá válása előtt azonosítják. Ezek a betekintések nem helyettesítik a felhasználói döntéseket, hanem erősítik azokat azáltal, hogy rámutatnak a fokozott figyelmet igénylő helyzetekre.

A Magyron Fundix mindvégig a felhasználó kezében hagyja az irányítást. Az információk intuitív felületen történő elemzésével lehetővé teszi, hogy a logika és az adatok stratégiai cselekvésekké álljanak össze. Ez támogató környezetet teremt, ahol az intuíció és a bizonyítékok együtt dolgoznak, csökkentve a bizonytalanságot és elősegítve a magabiztos kereskedési döntéseket.

A Magyron Fundix mesterséges intelligencia által vezérelt technikákat használ a kereskedési minták, az érzelmek és az árfolyamok viselkedésének változásainak nyomon követésére. A főbb gazdasági változások nyomon követésével újraértelmezi a piacot. Ez lehetővé teszi a digitális eszközpiacok felhasználói számára, hogy jobban megértsék a hangulatot, és megalapozott döntéseket hozzanak minden kereskedési tevékenység során.

A Magyron Fundix elemzi az általános árat, beleértve a devizapár árát, az aktuális kereskedési mozgást vagy kereskedési irányt, valamint az emberek általános véleményét a forex piacról. Számos tényező együttesen nagyobb képet alkot a piac keresztmetszetéről, hogy a felhasználó gyorsabban és elfogulatlanul megkapja a szükséges információkat.

A Magyron Fundix adatértelmezése leegyszerűsíti a számadatokat és javítja a döntéshozatalt. Támogató rendszerként szolgál, nem helyettesíti a manuális elemzést, segítve a felhasználókat a körülmények hatékonyabb felmérésében, miközben teljes mértékben kézben tartják stratégiáikat és folyamataikat.

| 🤖 Belépési díj | Nincs belépési díj |

| 💰 Felmerülő költségek | Ingyenes |

| 📋 A csatlakozás folyamata | A regisztráció egyszerűsített és gyors |

| 📊 Érintett témák | Oktatás kriptovalutákról, forex piacokról és befektetési stratégiákról |

| 🌎 Jogosult országok | Szinte minden ország támogatott, kivéve az Egyesült Államokat |